Understanding Housing Benefit Bedroom Tax Exemptions

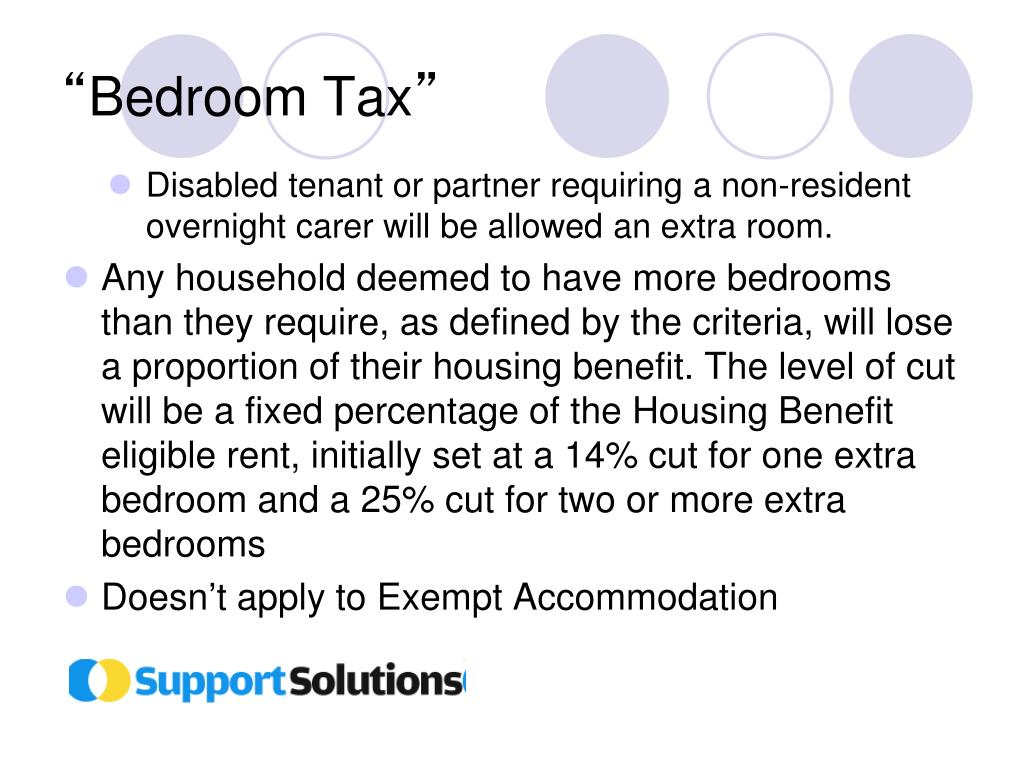

The bedroom tax, also known as the under-occupation penalty, is a policy implemented by the UK government in 2013. It reduces the amount of housing benefit paid to tenants who are deemed to have one or more spare bedrooms in their homes. This policy aims to encourage people to move to smaller properties, thereby freeing up larger homes for families with greater needs. However, it has faced criticism for its impact on vulnerable groups, particularly those with disabilities or caring responsibilities.

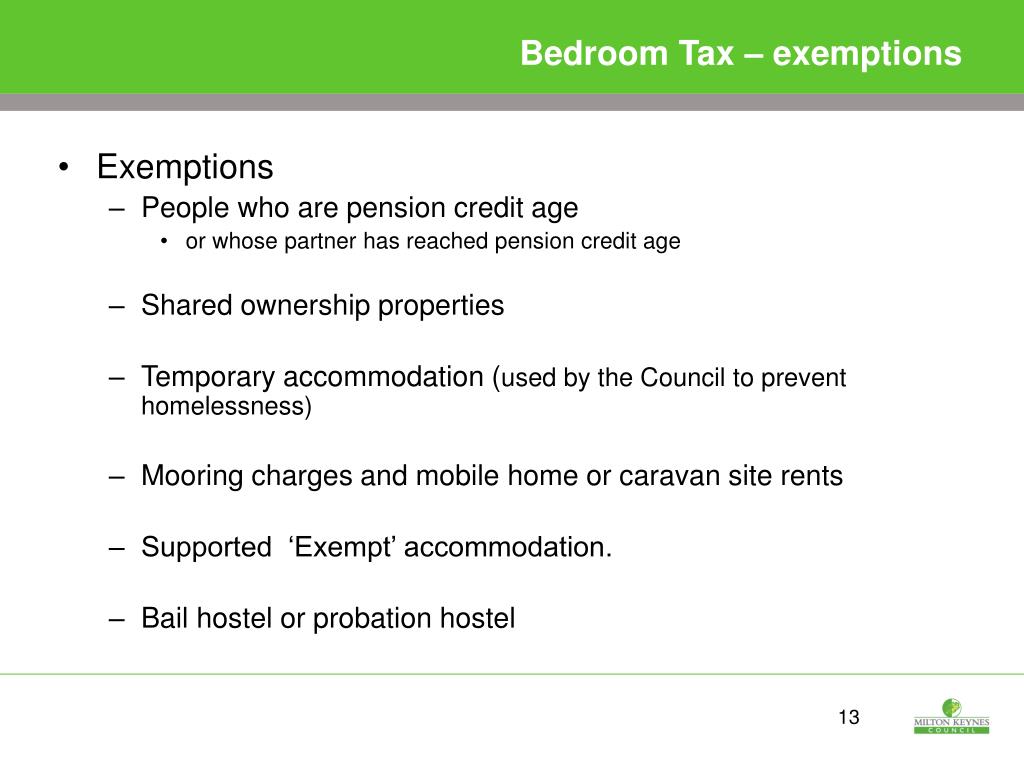

Exemption Criteria for the Bedroom Tax

Exemptions from the bedroom tax are granted to individuals who meet certain criteria, acknowledging that some people genuinely require extra space due to their circumstances.

Medical Conditions and Disabilities

Individuals with medical conditions or disabilities may be exempt from the bedroom tax if they require an additional bedroom for medical equipment, a carer, or due to the nature of their disability. For example, a person with a severe mobility impairment might need a bedroom for their wheelchair and other assistive devices. Similarly, someone with a chronic illness requiring regular visits from a carer may need an extra bedroom for the carer to stay overnight.

Caring Responsibilities

Individuals who have caring responsibilities for a disabled child or adult may be exempt from the bedroom tax if the person they care for needs a separate bedroom. This exemption is granted to ensure the carer has a private space to rest and recuperate, particularly if the person they care for requires constant attention.

Examples of Exemption Granting and Denial

The following examples illustrate situations where exemptions from the bedroom tax are granted or denied:

Exemption Granted

* A single parent with a child who has severe autism and requires a separate bedroom for their own space and safety.

* A couple where one partner has a debilitating illness and requires a carer to stay overnight.

* A family with a disabled child who needs a bedroom for their medical equipment and another for their carer.

Exemption Denied

* A family with three children who have a spare bedroom that is used for storage.

* A couple with two bedrooms who both work full-time and use the second bedroom as a home office.

* A single person with a spare bedroom who uses it for hobbies and leisure activities.

Navigating the Exemptions Process: Housing Benefit Bedroom Tax Exemptions

Applying for a bedroom tax exemption can be a complex process, but understanding the steps involved and the necessary documentation can make it more manageable. This section Artikels the key steps, provides guidance on communication with housing benefit authorities, and explains the potential appeals process.

Required Documentation and Contact Information

To apply for a bedroom tax exemption, you will need to provide evidence to support your claim. The specific documents required may vary depending on your circumstances and the local authority you are dealing with. However, common documentation includes:

- Proof of your address and identity (e.g., passport, driving license, utility bills)

- Evidence of your disability or health condition (e.g., medical report, disability allowance letter)

- Proof of the number of people living in your home (e.g., birth certificates, tenancy agreement)

- Evidence of your income and savings (e.g., payslips, bank statements)

- Evidence of any other relevant circumstances (e.g., care needs, medical equipment)

It is crucial to contact your local council’s housing benefit department to inquire about specific requirements and obtain the necessary application forms.

Communicating with Housing Benefit Authorities

Effective communication with housing benefit authorities is vital throughout the exemption process. When submitting your application, ensure it is complete and accurate.

“Clearly state your circumstances and the specific exemption you are claiming. Include all relevant documentation to support your claim.”

If you are unsure about any aspect of the application, do not hesitate to contact the housing benefit department for clarification.

Appealing a Decision, Housing benefit bedroom tax exemptions

If your exemption claim is rejected, you have the right to appeal the decision. The appeals process involves submitting a formal request to review the decision. You must provide reasons for your appeal, including evidence to support your claim.

“The grounds for appealing a decision include errors in the assessment, new evidence, or a change in circumstances.”

The local council will review your appeal and issue a final decision. If you are still dissatisfied, you can seek further review through an independent tribunal.

Impact and Implications of Bedroom Tax Exemptions

The bedroom tax, formally known as the “under-occupation penalty,” has been a controversial policy in the UK, impacting tenants receiving housing benefit. While exemptions exist for certain individuals and circumstances, the policy’s impact remains significant, both financially and socially. Understanding the implications of bedroom tax exemptions is crucial for those seeking to navigate this complex system.

Financial Benefits and Challenges

Exemptions from the bedroom tax can provide significant financial relief for individuals and families. By avoiding the penalty, they can retain a greater portion of their housing benefit, alleviating financial strain and allowing for better management of household expenses.

- Reduced Housing Costs: Exemptions prevent the reduction of housing benefit, directly impacting tenants’ monthly expenses. For example, a family with a disabled child requiring an additional bedroom for medical equipment might avoid a substantial reduction in their housing benefit, significantly reducing their monthly housing costs.

- Increased Financial Stability: By retaining more of their housing benefit, individuals can improve their overall financial stability, potentially reducing reliance on other benefits or support services. This can lead to greater financial independence and a sense of security.

- Reduced Debt Risk: Avoiding the bedroom tax penalty can help prevent individuals from accumulating debt due to reduced income. This can protect their credit rating and prevent financial instability in the long term.

However, the financial implications of the bedroom tax can be complex, even with exemptions.

- Potential for Increased Rent: Landlords might increase rent for properties deemed “too large” under the bedroom tax rules, even for tenants with exemptions. This can result in a financial burden for tenants, negating the benefits of the exemption.

- Limited Access to Suitable Housing: The availability of suitable housing for those with exemptions might be limited, especially in areas with high demand. This can lead to longer waiting times and difficulty finding affordable accommodation that meets their needs.

- Complex Application Process: Navigating the exemption process can be challenging, requiring thorough documentation and understanding of eligibility criteria. This can be overwhelming for individuals struggling with financial difficulties or lacking the resources to navigate complex bureaucratic procedures.

Social Implications of the Bedroom Tax

The bedroom tax has been criticized for its potential to exacerbate social inequalities and negatively impact vulnerable groups. While exemptions aim to mitigate these effects, the policy’s broader social implications remain a concern.

- Increased Homelessness: The bedroom tax has been linked to increased homelessness, particularly for those unable to afford the penalty or find suitable alternative housing. This can have devastating consequences for individuals and families, impacting their well-being and access to essential services.

- Strain on Public Services: The financial and social challenges faced by individuals impacted by the bedroom tax can place a strain on public services, such as shelters, support services, and mental health care. This can lead to increased demand and resource limitations for those in need.

- Discrimination and Stigma: The bedroom tax has been associated with stigma and discrimination, potentially impacting individuals’ self-esteem, social inclusion, and access to opportunities. This can further marginalize vulnerable groups and perpetuate existing inequalities.

Alternative Housing Solutions and Policies

Recognizing the potential negative impacts of the bedroom tax, alternative housing solutions and policies have been proposed to address the concerns surrounding the policy.

- Increased Affordable Housing Supply: Expanding the availability of affordable housing options can reduce pressure on individuals and families impacted by the bedroom tax, providing more choices and opportunities for those seeking suitable accommodation.

- Housing Benefit Reform: Revising the housing benefit system to address the complexities of the bedroom tax and its potential impact on vulnerable groups can promote fairness and equity in the allocation of resources.

- Support for Disabled Individuals: Implementing policies that provide targeted support for disabled individuals and families, ensuring access to suitable housing and resources, can address the specific challenges faced by this group.

Navigating the labyrinthine world of housing benefit bedroom tax exemptions can feel like trying to find a needle in a haystack, but fear not, there’s a light at the end of the tunnel! If you’re struggling with the bedroom tax, maybe a smaller, more manageable home is the answer?

Check out these 2 bedroom modern house plans in South Africa for inspiration. After all, a smaller footprint can lead to a bigger, brighter future – both financially and in terms of your mental wellbeing. And remember, there are resources out there to help you navigate this complicated system, so don’t be afraid to reach out for support.

So, you’re thinking about applying for housing benefit and wondering about the dreaded bedroom tax? Well, let’s just say it’s not a walk in the park. But hey, if you’re lucky enough to have a large family, maybe you’ll qualify for an exemption! Or, you could just ditch the whole housing benefit drama and book yourself a luxurious 5 bedroom holiday house for a truly stress-free getaway.

Just imagine, no more worrying about bedroom tax, just sun, fun, and endless space for everyone! But hey, if you’re determined to navigate the housing benefit system, good luck to you!